ECONOMIC OUTLOOK IN AUSTRALIA

Australia is a consistently top performing and financially stable economy, continuously providing a range of business opportunities and competitive advantage to foreign investors who want to establish, expand or expedite their enterprise through commercial trading, services or products. Famed for its AAA credit rating, the economic stability of the country boosts the confidence of local and international-based corporations.

Advanced infrastructure, strong trade support, impressive healthcare system, effective fiscal strategies and a structured annual budget consistently drive economic growth. For 2017, the Australian government is focused on a ten-year enterprise tax plan that aims to increase national and household income by providing incentives for businesses to expand, invest, innovate and employ staff, which in turn is expected to deliver a permanent increase in GDP.

The steady economic growth, tax incentives and government subsidies on investments are feasible possibilities for business owners who wish to commence operations in Australia.

Industry Overview

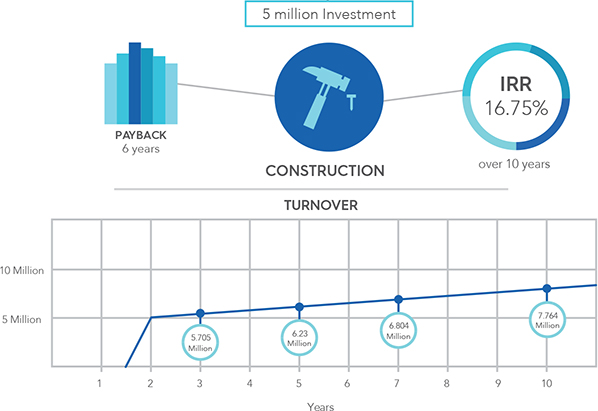

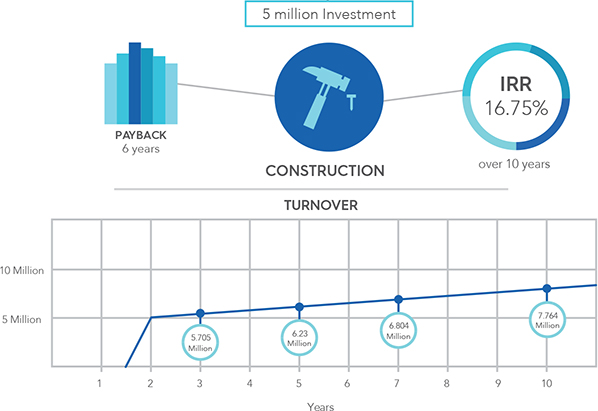

As one of the largest contributors to Australia’s GDP, the construction sector remains strong in driving employment and economic productivity.

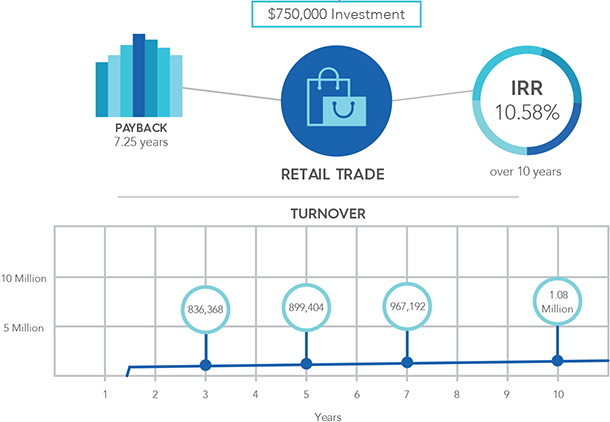

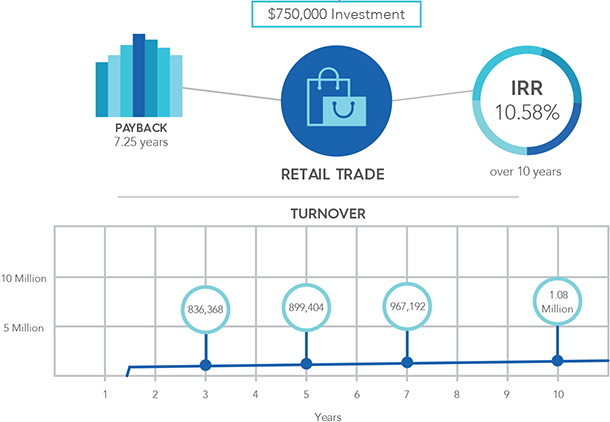

Driven by strong economic conditions in Australia and high demand for popular brands, influx of international retailers is still evident.

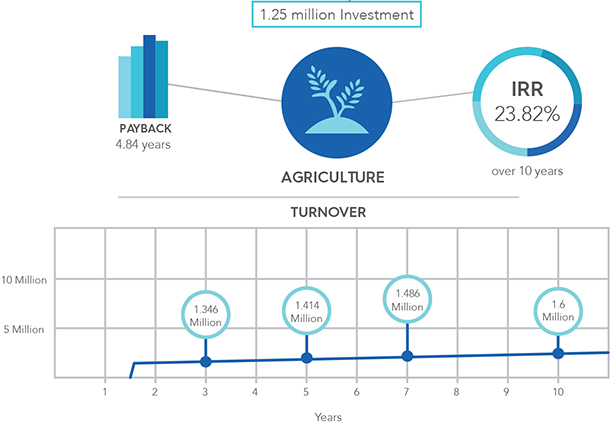

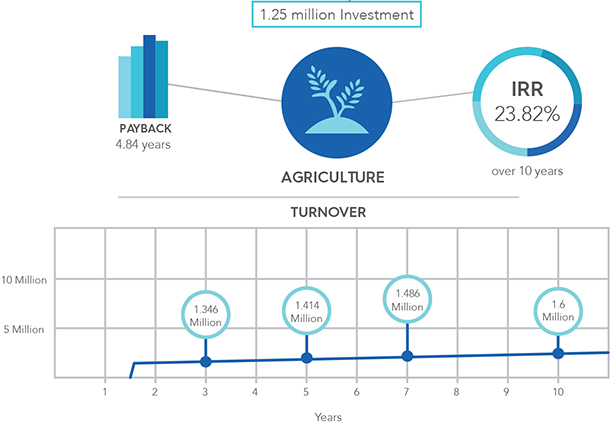

Agriculture remains to play a vital role as a contributing force in the economic and social sustainability in Australia.

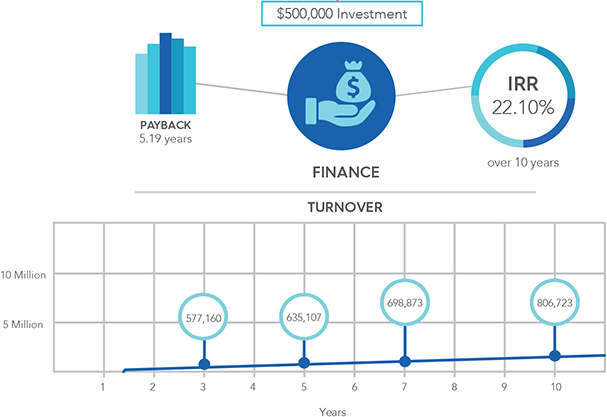

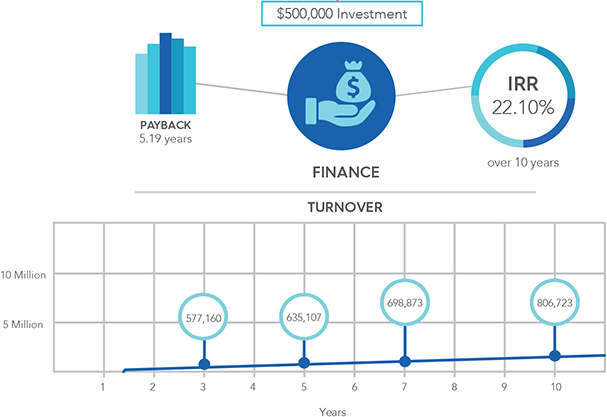

The financial services sector remains to be the biggest contributor and main driver of growth with a reported GDP of $140 billion over the last year.

GLOBAL ENERGY INVESTMENT OPPORTUNITIES

Our global presence can provide investment options in many different countries to suit investor preferences. Some of the potential options explored below include China, India, Malaysia and Indonesia. These countries have been selected due to the high potential of growth of emerging solar technology and favourable market conditions.

CHINA

- Fastest growing solar market globally

- Low interest rate of below 3% makes alternative investment opportunities more attractive

- According to the 13th Five-Year Plan (2016-2020), China aims to install a total 100 GW solar power capacity by 2020

- 71% of this capital investment value would be required for the development of distributed solar PV projects between 2014-2017 to cover costs of US$100 Billion

- China’s solar power potential at around 19,536,000 terawatt-hours (TWh) per year

INDIA

- Solar Power potential estimated at 750 GW as per National Institute of Solar Energy

- Current solar power installed capacity is around 3 GW less than 0.5% of the estimated potential

- The Jawaharlal Nehru Solar Mission is estimated to increase capacity to 100 GW across 12 states by 2022

- Fluctuating interest rates and a high inflation rate make alternative investment opportunities more attractive

MALAYSIA

- The Feed-in Tariff (FIT) system is part of a larger development initiative set forth by the Malaysian government in June 2010 to promote renewable energy

- Local electricity retailers to purchase power through FIT’s at a rate from unto 38 cents per kilowatt

- Targets 5.5% of energy production to be derived from renewable sources by 2015 and 11% by 2020

- Low interest rate of 3.25% and high inflation rate of 4% ensure alternative investments are more attractive

INDONESIA

- Ambitious plan to raise the renewable energy share to 23-25% by 2025 from just 6%

- Tenders issued towards construction of solar installations at 80 locations in Indonesia

- State electricity firm plans to develop new solar power plant projects adding 620 megawatts (MW) by 2020

- Low real interest rate of 3% makes alternative investments more attractive than the bank

Benefits of Solar Investment

Investing in solar PV comes with a wide range of benefits including:

✓

Obtain a higher return than the risk-free bank rate for an equivalent period of time

✓

The return on investment does not fluctuate and is fixed over the investment period

✓

Strong expected growth in the sector as it is an emerging and quickly growing market

✓

Relatively low capital costs required for a high rate of return

✓

The risk of financing solar projects can be reduced through power purchase agreements